In the previous article, we wrote about some social media overviews in 2022. Read on for more useful information.

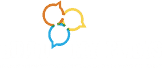

YouTube’s ad reach passes 2.5 billion

According to our most recent data, adverts on YouTube now reach more than 2.5 billion viewers. A figure that has increased by a whopping 11.9 percent (+271 million users) in the last year.

Furthermore, these data only account for users in around 75 of the world’s largest economies. This implies that the total reach of YouTube adverts is likely far higher than these published figures show.

According to available data, YouTube commercials now reach about one in every three individuals on the planet, with that ratio jumping to 37.7 percent of adults aged 18 and up.

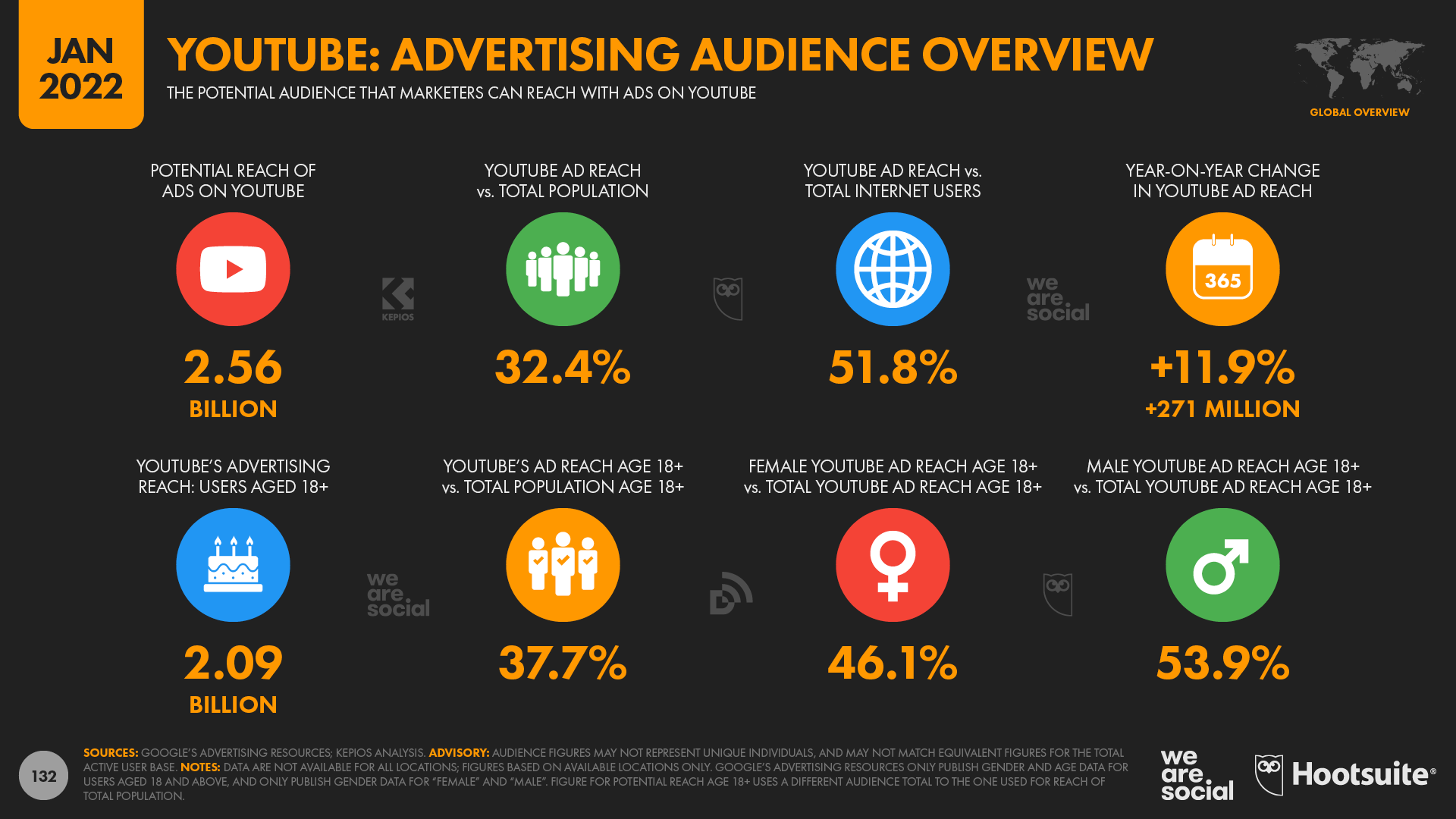

However, if we simply look at the nations for which data is available, we see a significantly more stunning picture.

YouTube advertising now reach more than three-quarters of adults aged 18 and above in much of the Western world, and more than 90% of all adults in 14 countries.

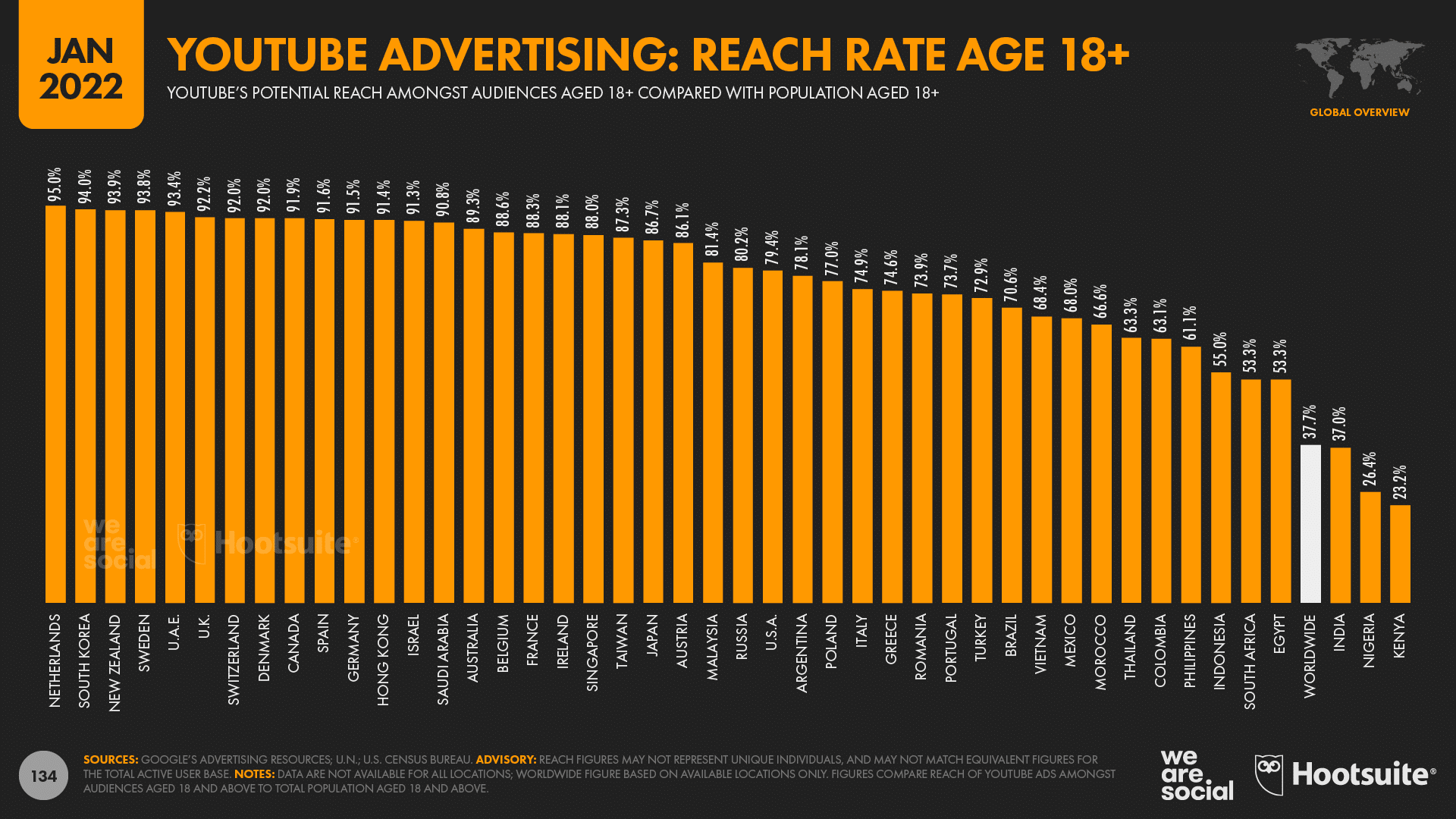

Aside from outstanding reach stats, marketers may be intrigued to find that music is becoming increasingly significant for YouTube’s worldwide viewers, with 11 of the platform’s top 20 search phrases connecting directly to music in the last year.

This trend can also be seen in our ranking of the platform’s most-subscribed channels and our revised ranking of the platform’s all-time most watched videos, both of which can be seen in the entire report.

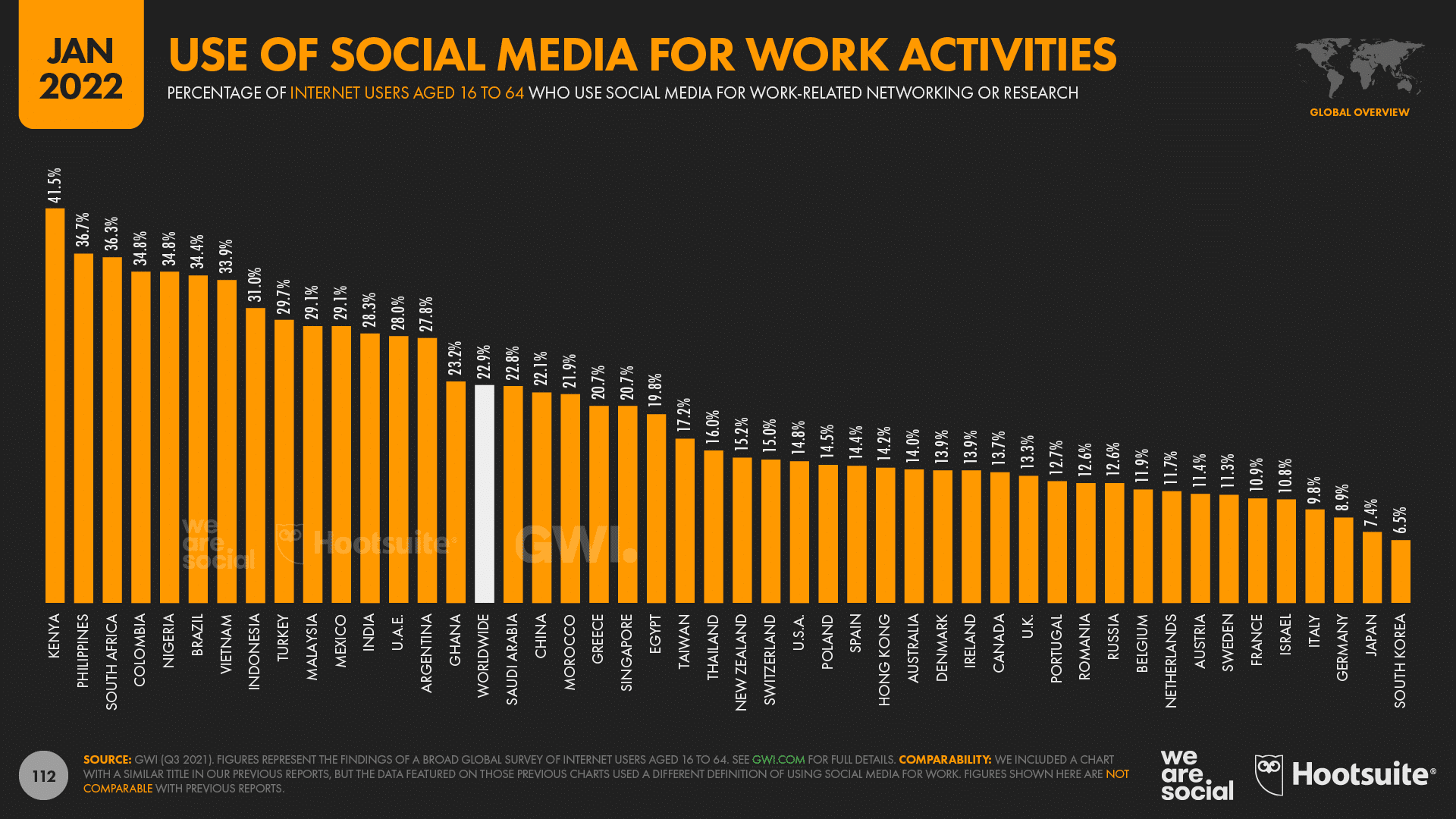

According to GWI’s most recent data, nearly one in every four internet users aged 16 to 64 currently utilizes social media for work-related purposes.

This figure, however, is far higher in many emerging economies.

More over four in ten working-age internet users in Kenya (41.5 percent) claim they use social media for work-related research.

Filipinos and South Africans are also significantly more likely than the worldwide average to use social media for work, with more than one-third of internet users aged 16 to 64 in both countries reporting that social media plays a part in their professional activities.

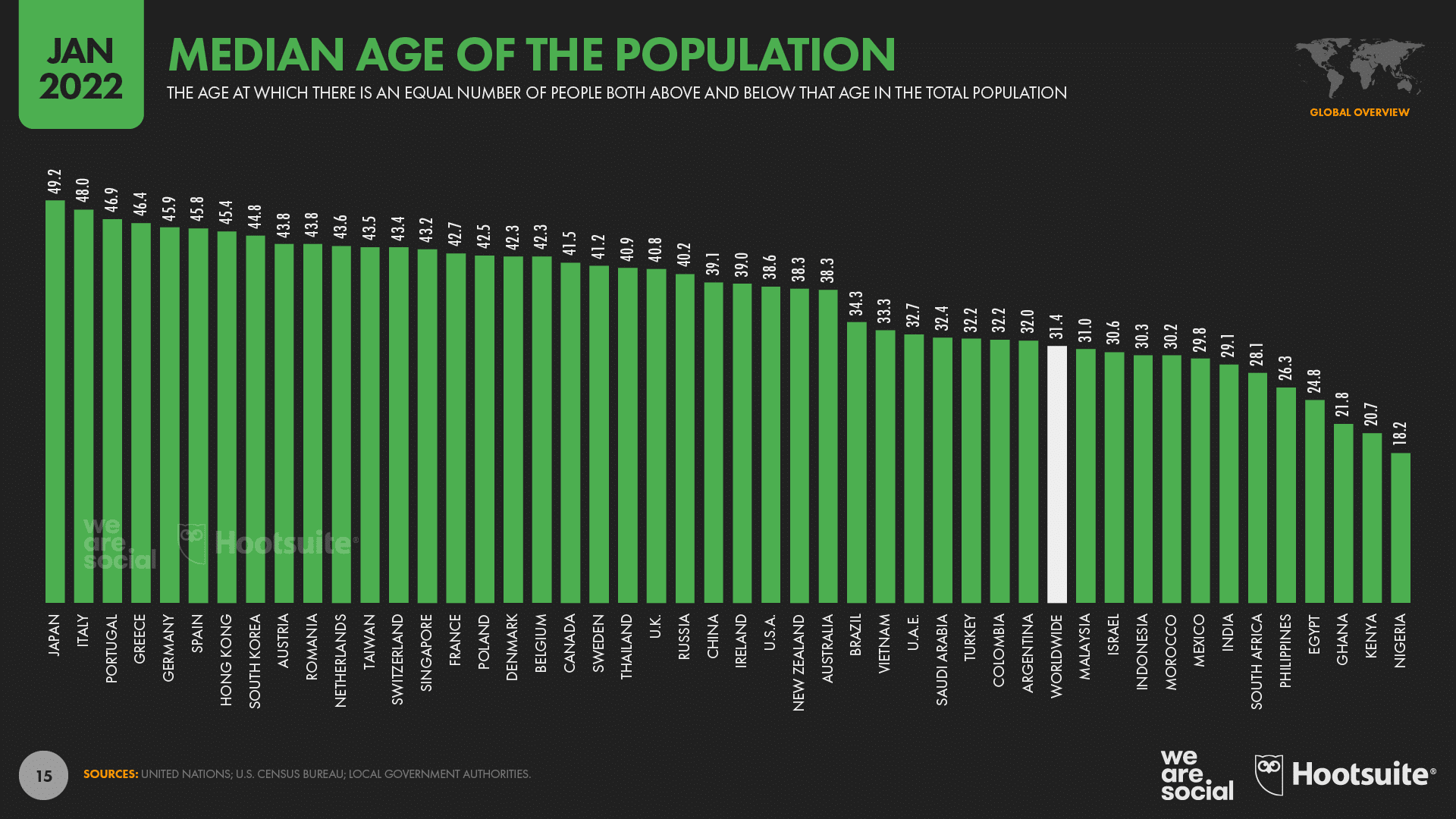

Although Greece appears to contradict this pattern, the median age of the entire population appears to have an essential influence in defining how likely people in a certain nation are to use social media for employment.

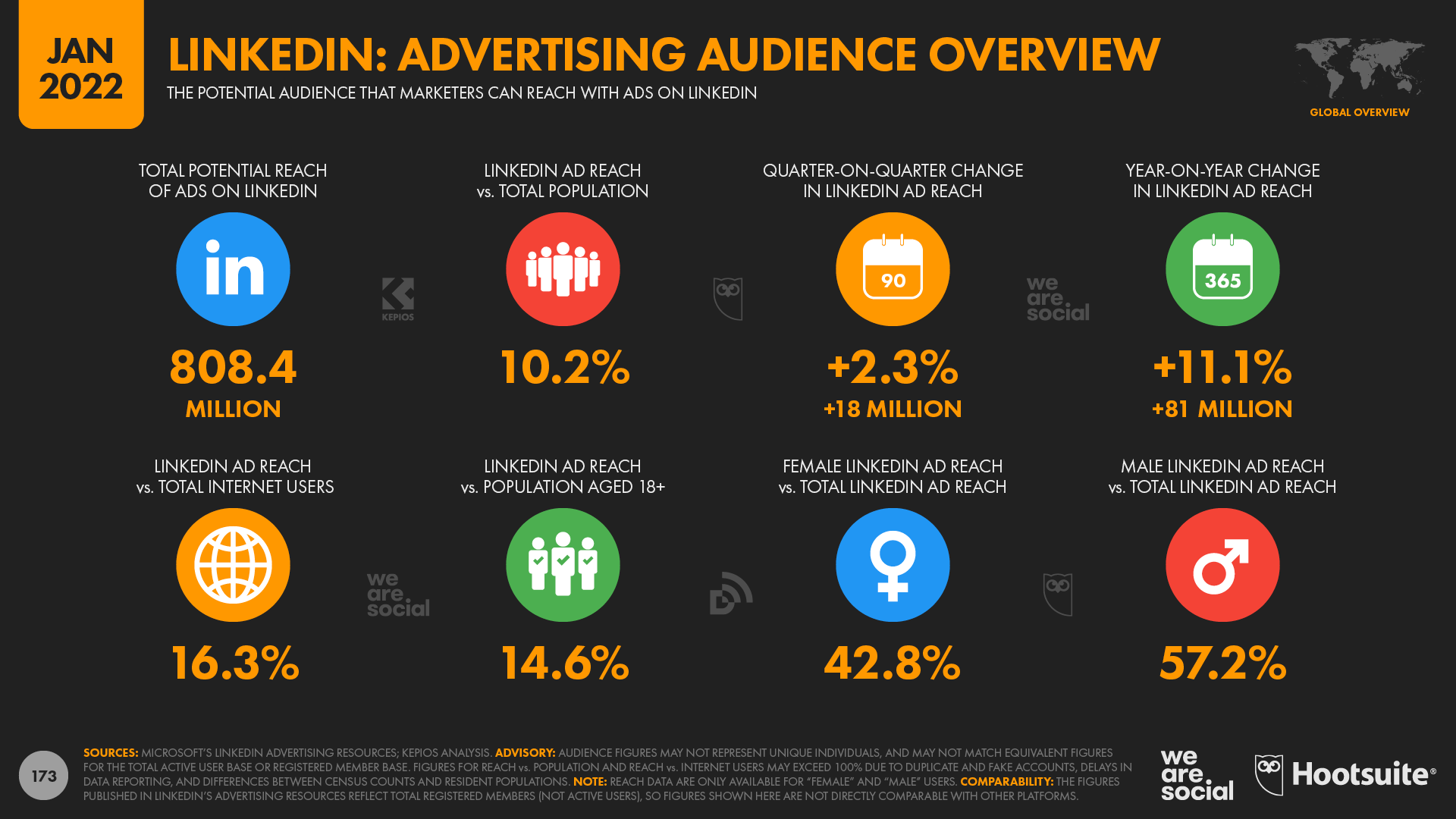

While we’re talking about professional social networking, it’s worth mentioning that LinkedIn has had another successful year.

According to our research of data available in the platform’s advertising resources, LinkedIn’s registered user base has expanded by 11% in the last year (+81 million members), bringing the global total to more than 808 million by the beginning of 2022.

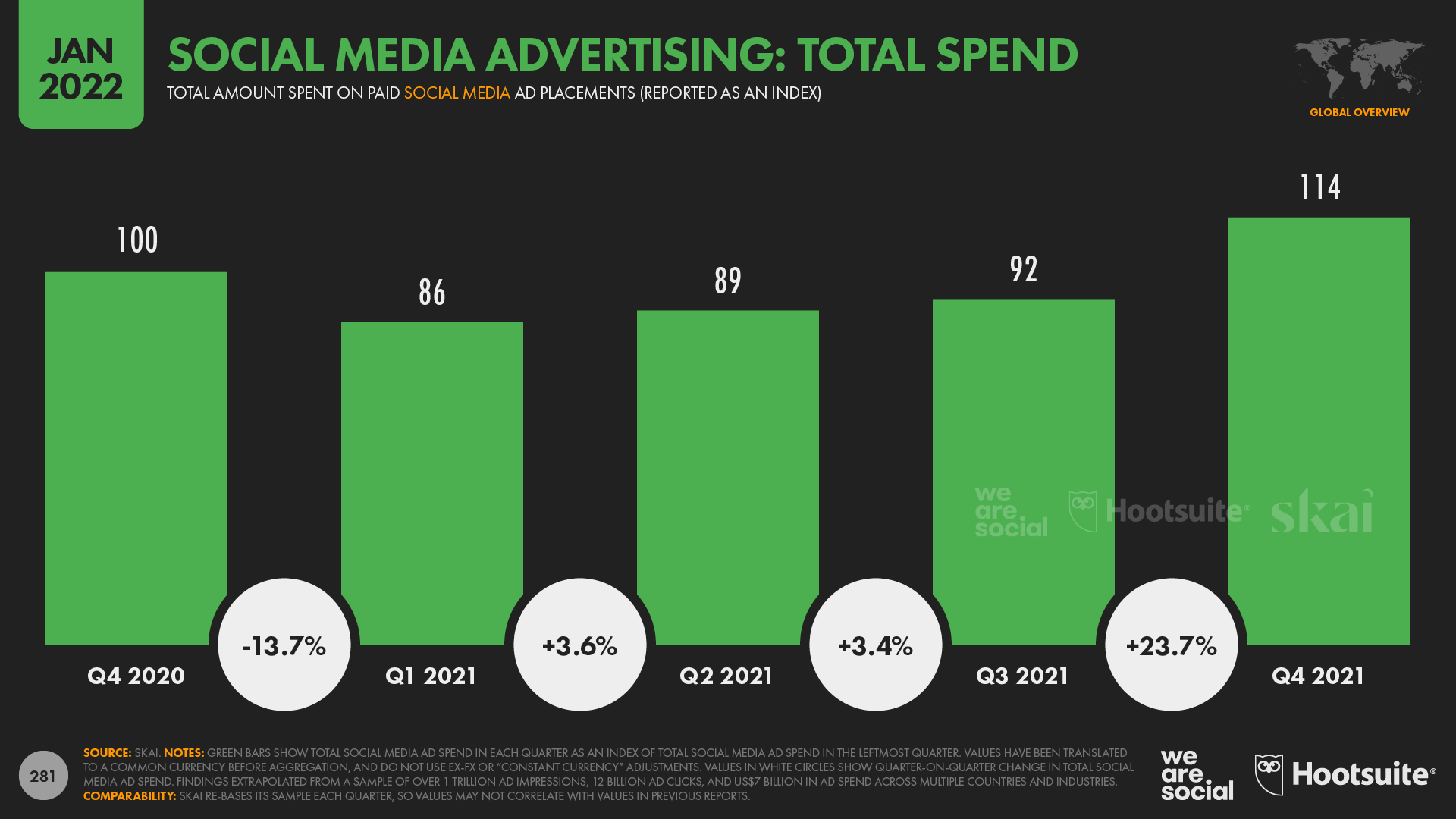

Social media ad spend up 17%

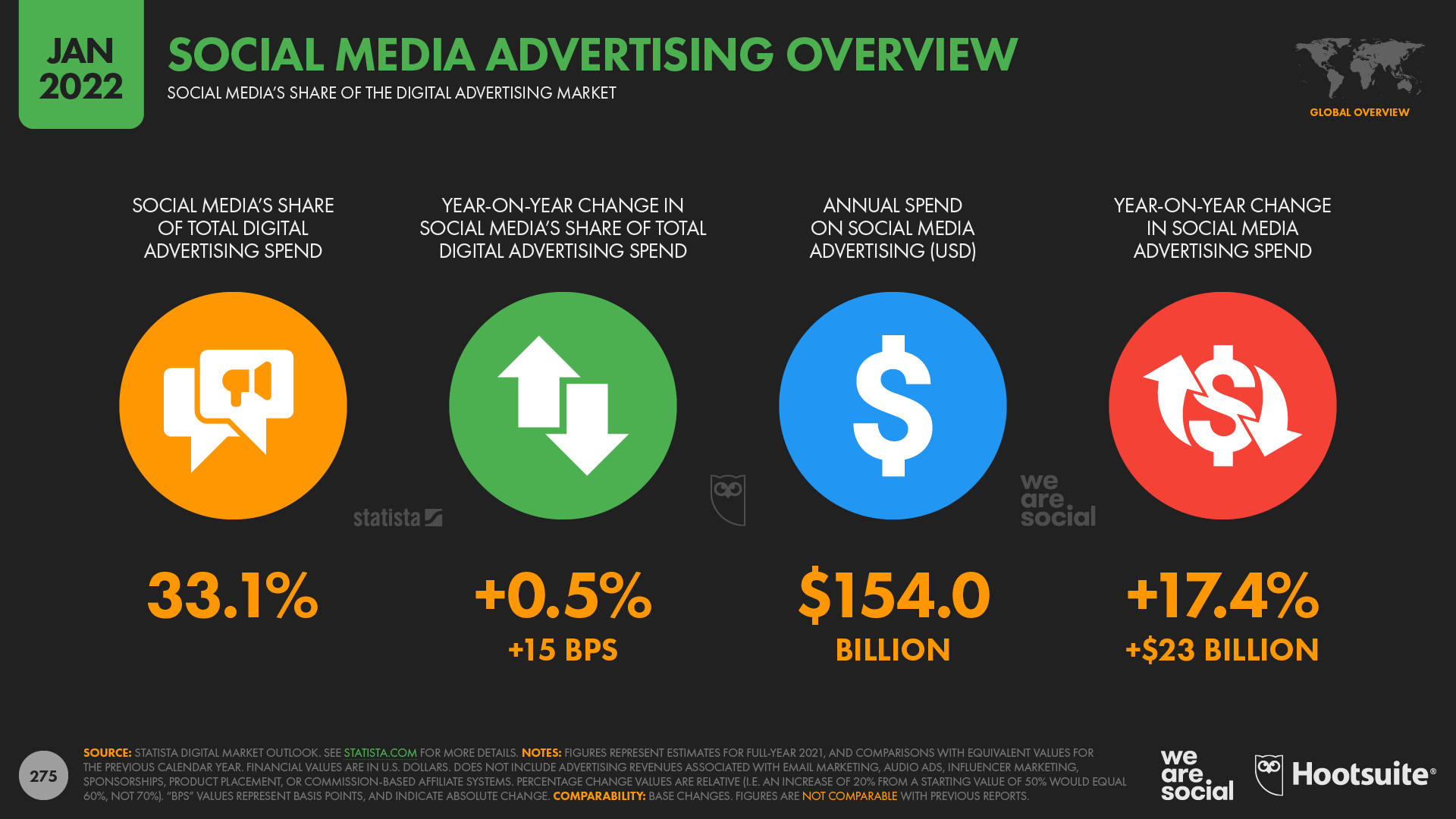

Several data indicators in this year’s research show that expenditure on social media advertisements has increased dramatically over the last year.

According to Statista, worldwide social media ad expenditure will top USD $150 billion in 2021, with social media advertisements accounting for about one-third (33.1%) of total digital spend.

Meanwhile, according to Skai’s most recent research, marketers spent 14% more on social media advertisements in Q4 2021 than they did in the same quarter in 2020.

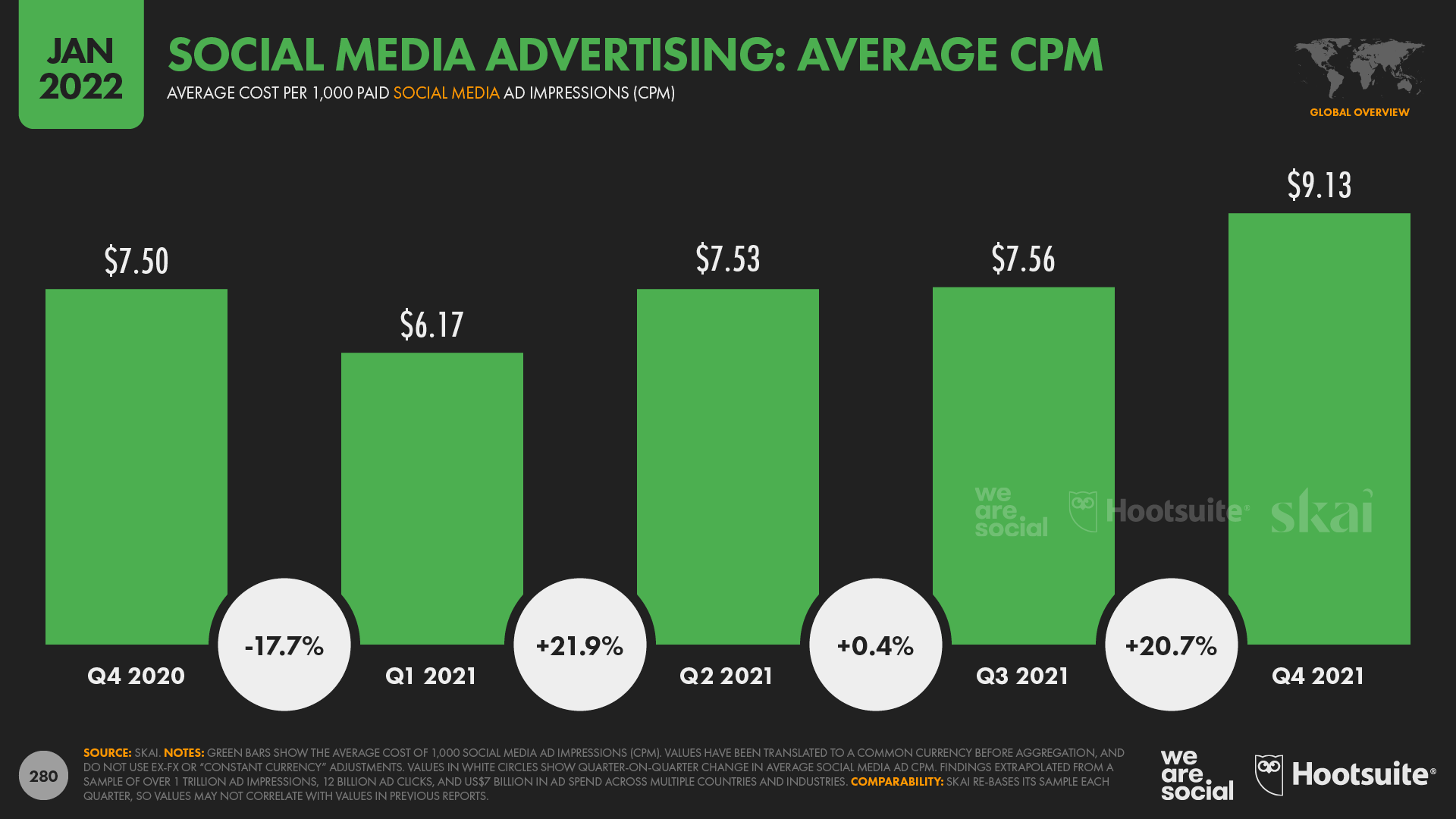

In keeping with the growth in total spending, Q4 social media CPMs increased by 21.7 percent year on year, with advertisers worldwide paying an average of USD $9.13 for 1,000 social media ad impressions in the last three months of 2021.

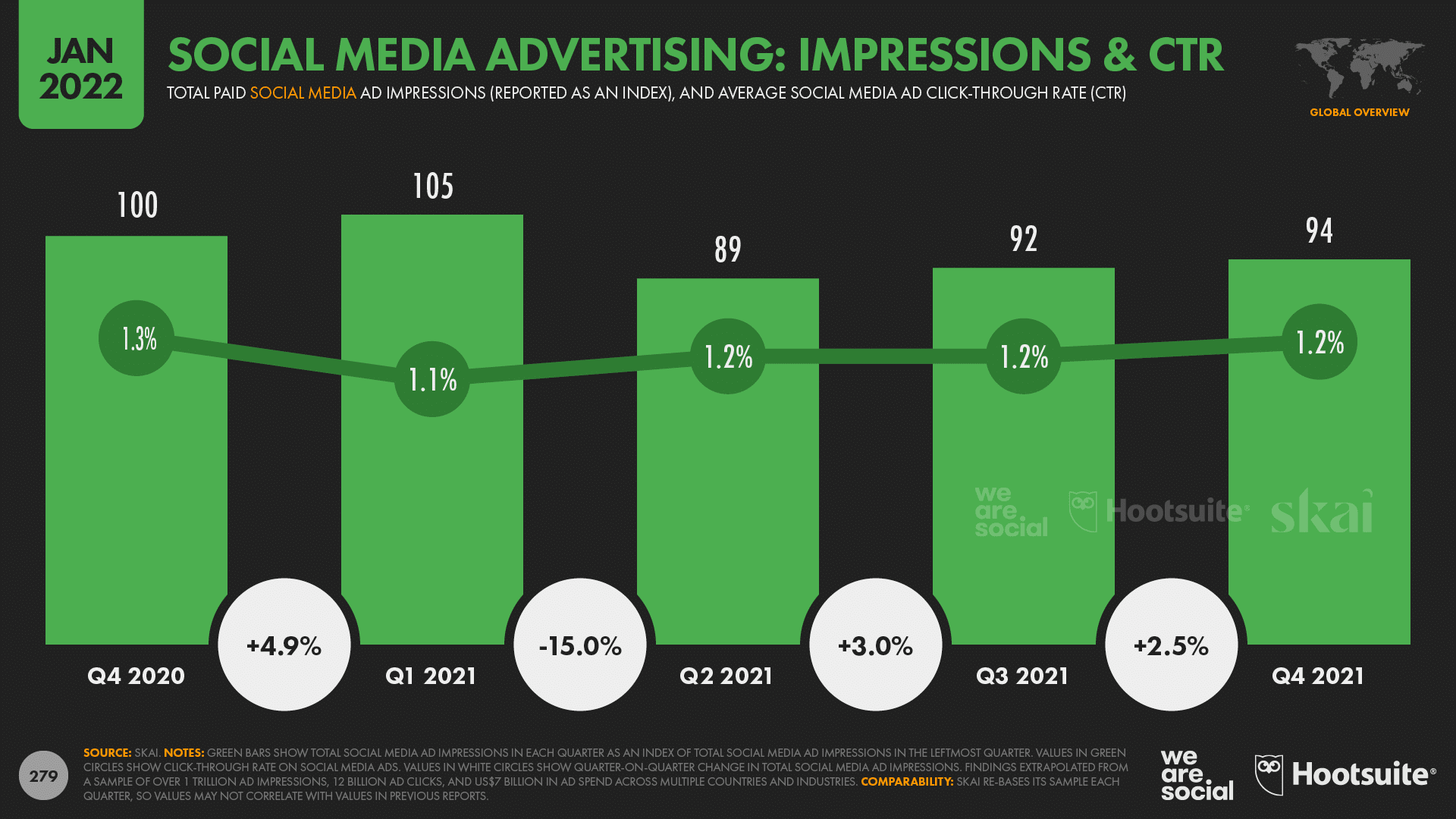

Importantly, although spending more overall, social media marketers generated fewer total impressions in Q4 2021 compared to the same period in 2020, owing to the higher average cost per impression.

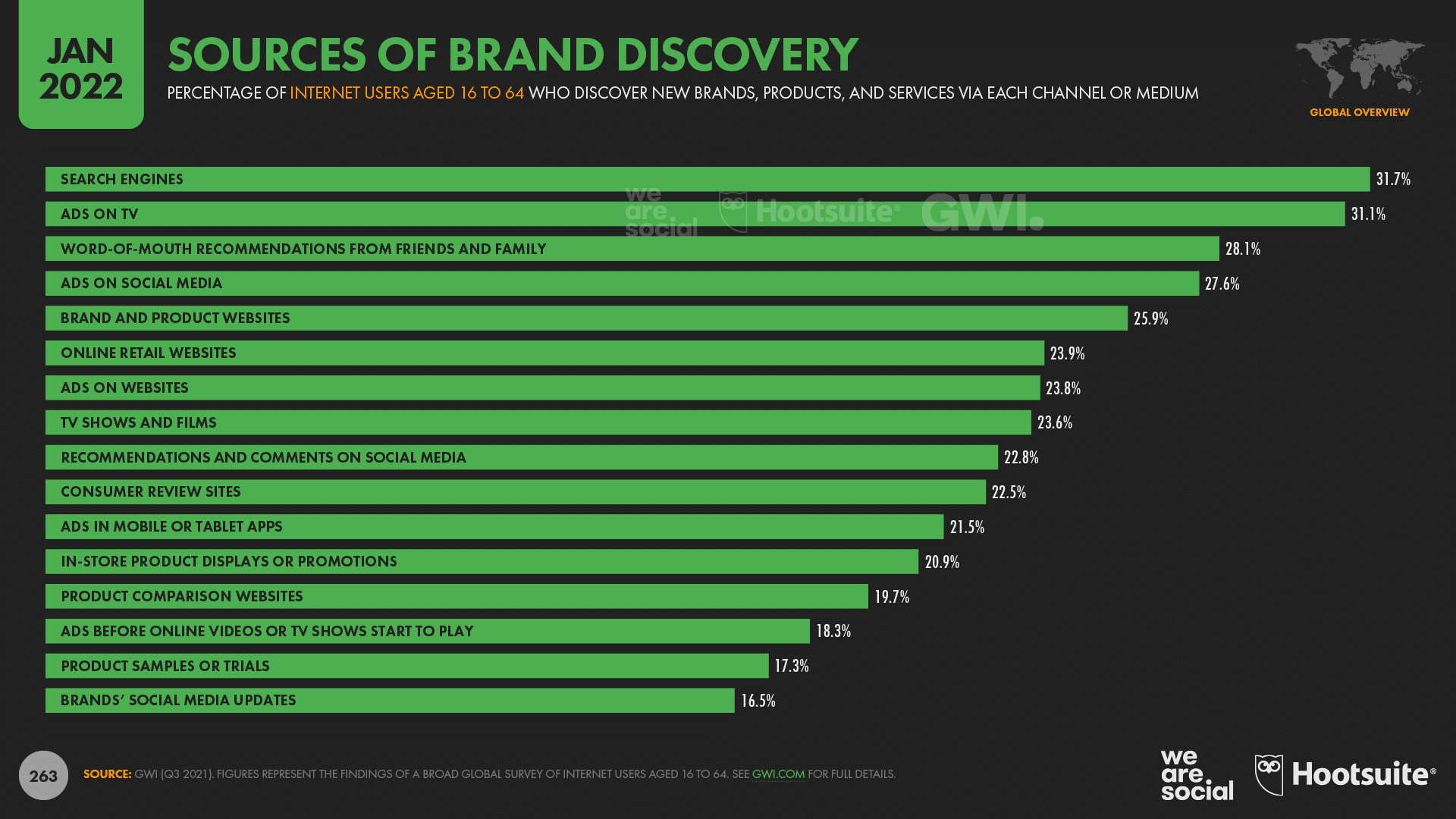

Social plays major role in brand discovery and research

Despite the growing expense of advertising, marketers will be relieved to find that new research validates the success of social media advertising.

According to GWI’s most recent research, more than one in every four internet users aged 16 to 64 (27.6 percent) learn about new companies, goods, and services through social media commercials, which is only slightly lower than the rate for TV ads (31.1 percent ).

However, search engines remain the most popular means of new brand discovery for the world’s internet users, with 31.7 percent of GWI’s sample stating they learnt about new companies through an online search.

Meanwhile, word-of-mouth recommendations are equally important for brand discovery, so marketers should reconsider how simple it is for consumers to communicate their brand and its many online presences via chat applications like WhatsApp and Telegram.

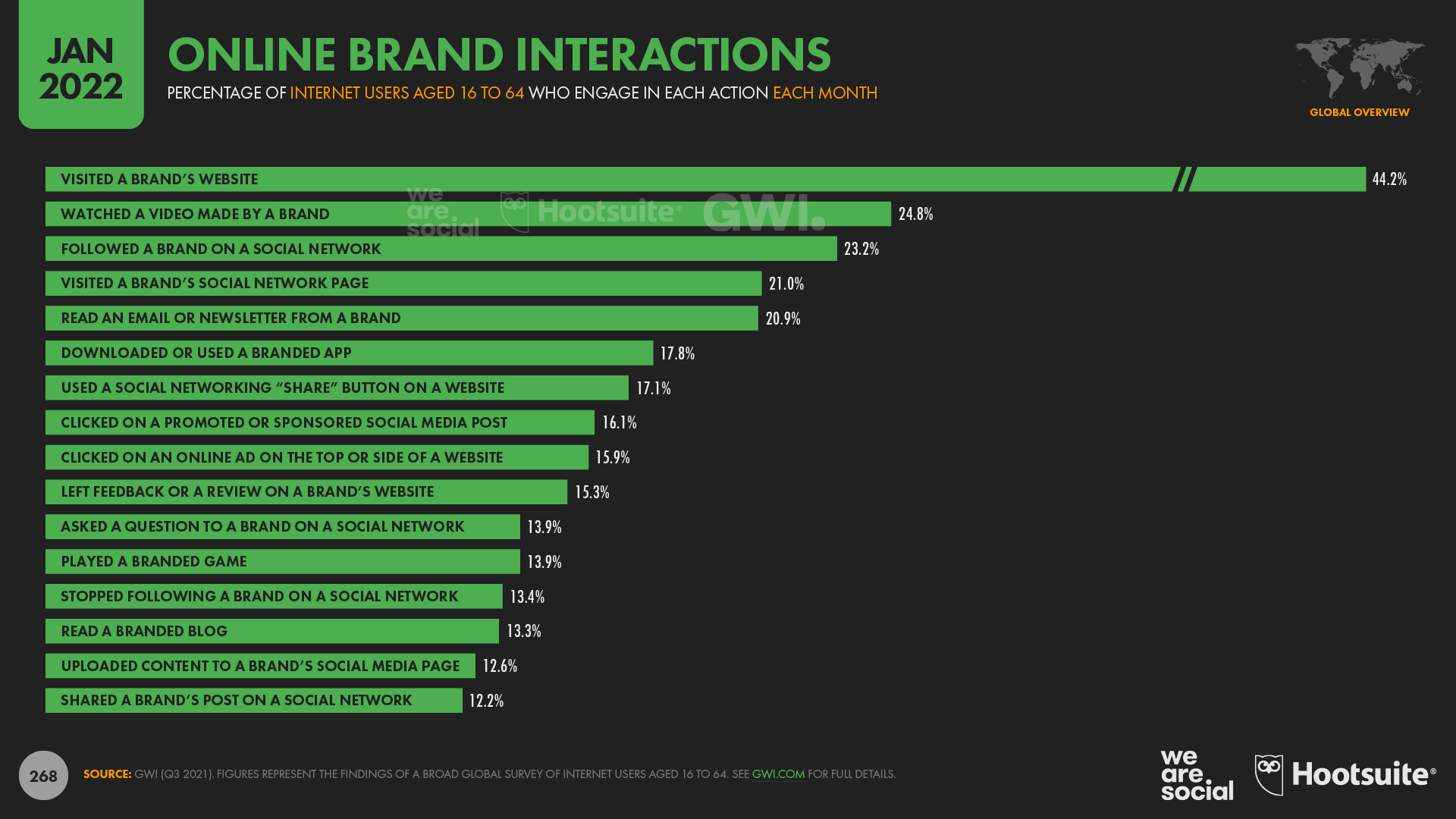

In addition to sponsored placements, it’s worth noting that nearly one in every four working-age internet users (23.2 percent) actively likes or follows a brand on social media at least once per month, and nearly one in every eight (12.2 percent) shares brand social media postings at least once per month.

According to GWI’s study, companies’ social media efforts also have a vital effect at various phases of the buying cycle.

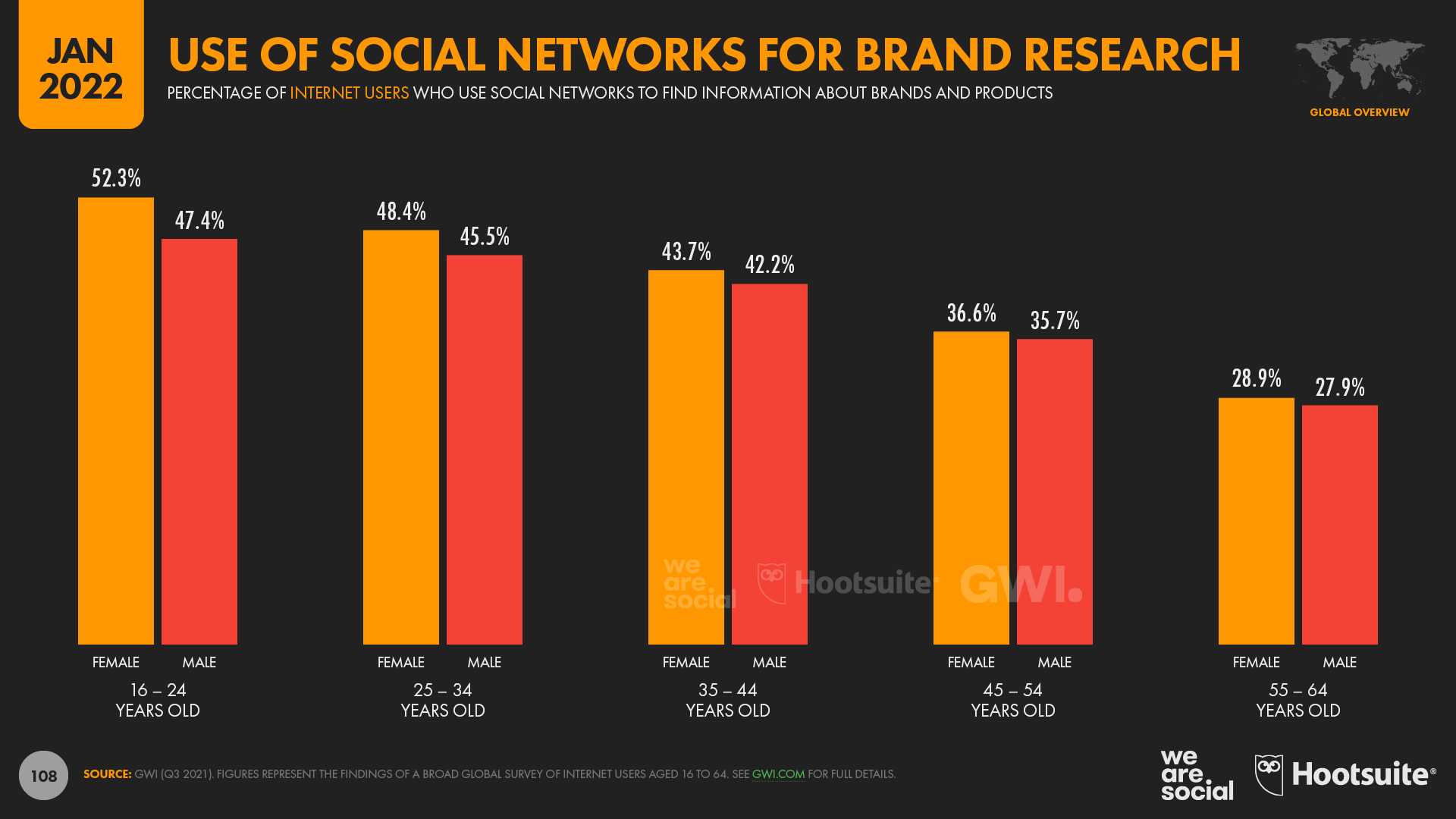

More than four in ten working-age internet users, for example, claim they use social networks particularly to study businesses and items they’re considering purchasing, with this percentage jumping to 50% of all internet users aged 16 to 24.

However, in addition to all of these great discoveries, there are some more concerning tendencies in this year’s statistics.

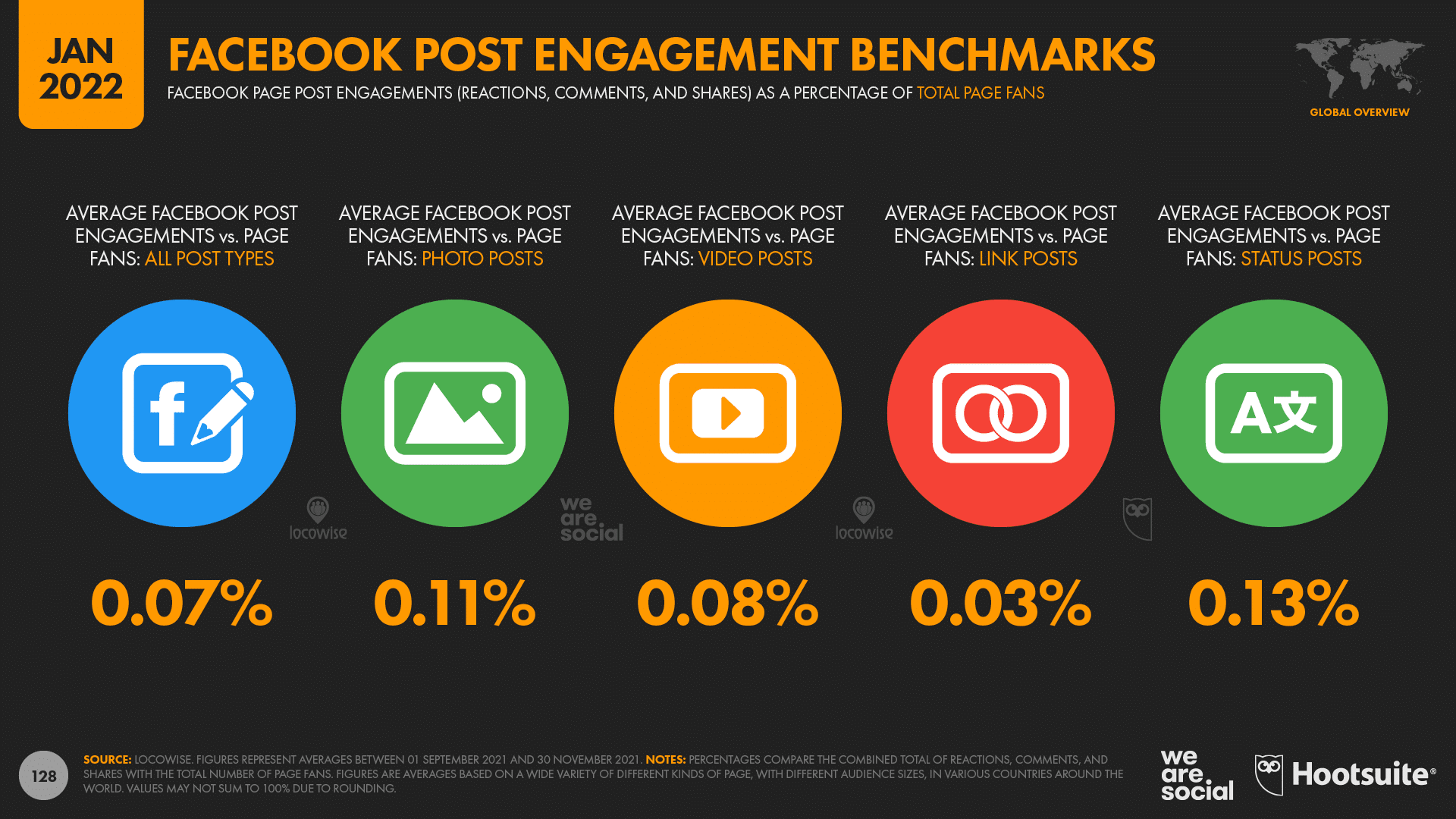

According to the most recent Locowise statistics, Facebook pages can currently expect an average engagement rate of only 0.07 percent.

That implies that just seven admirers out of every 10,000 will reply to, comment on, or share any particular post.

Worryingly, for pages with more over 100,000 fans, that average drops to only 0.05 percent.

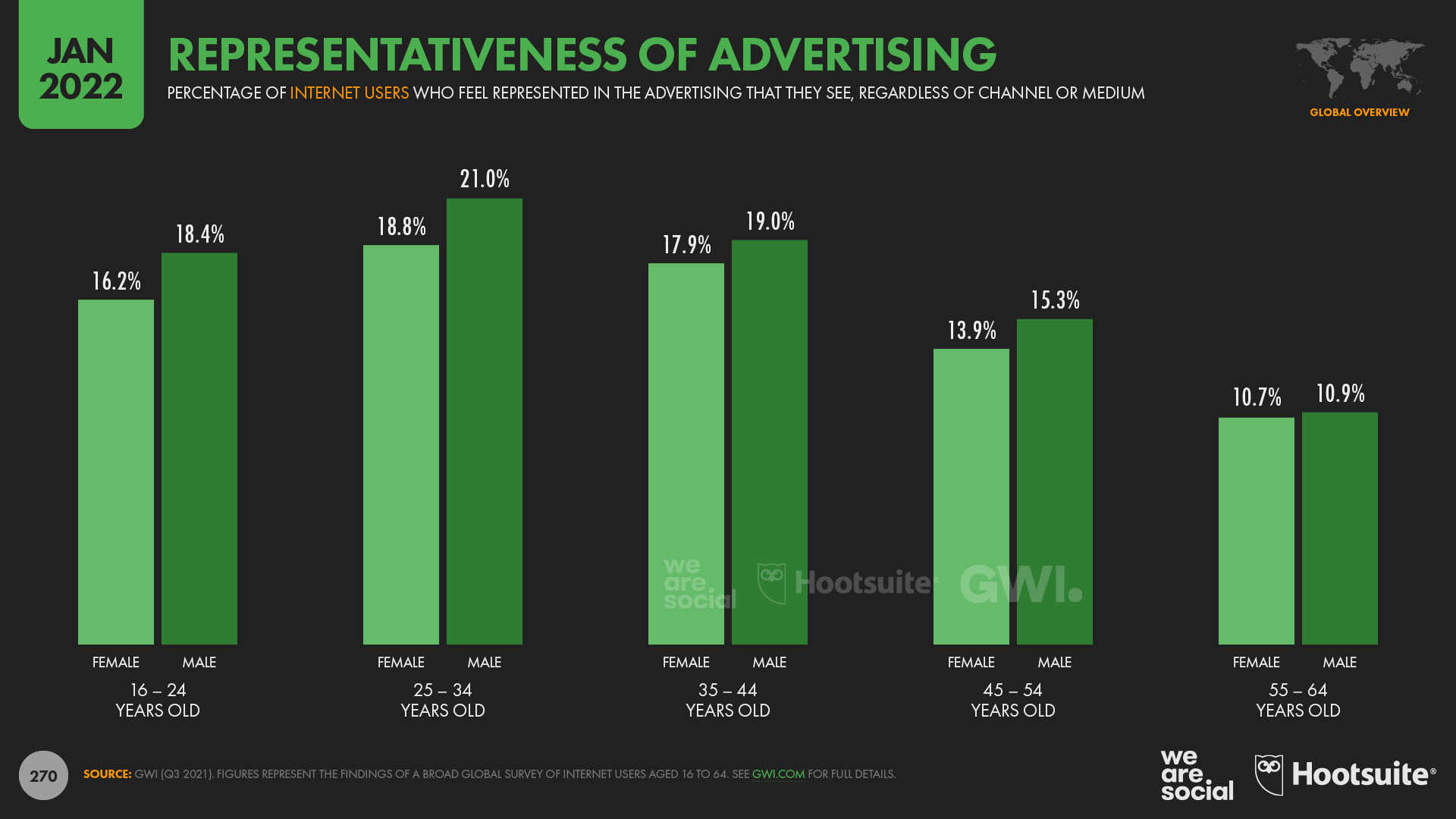

The representativeness of advertising

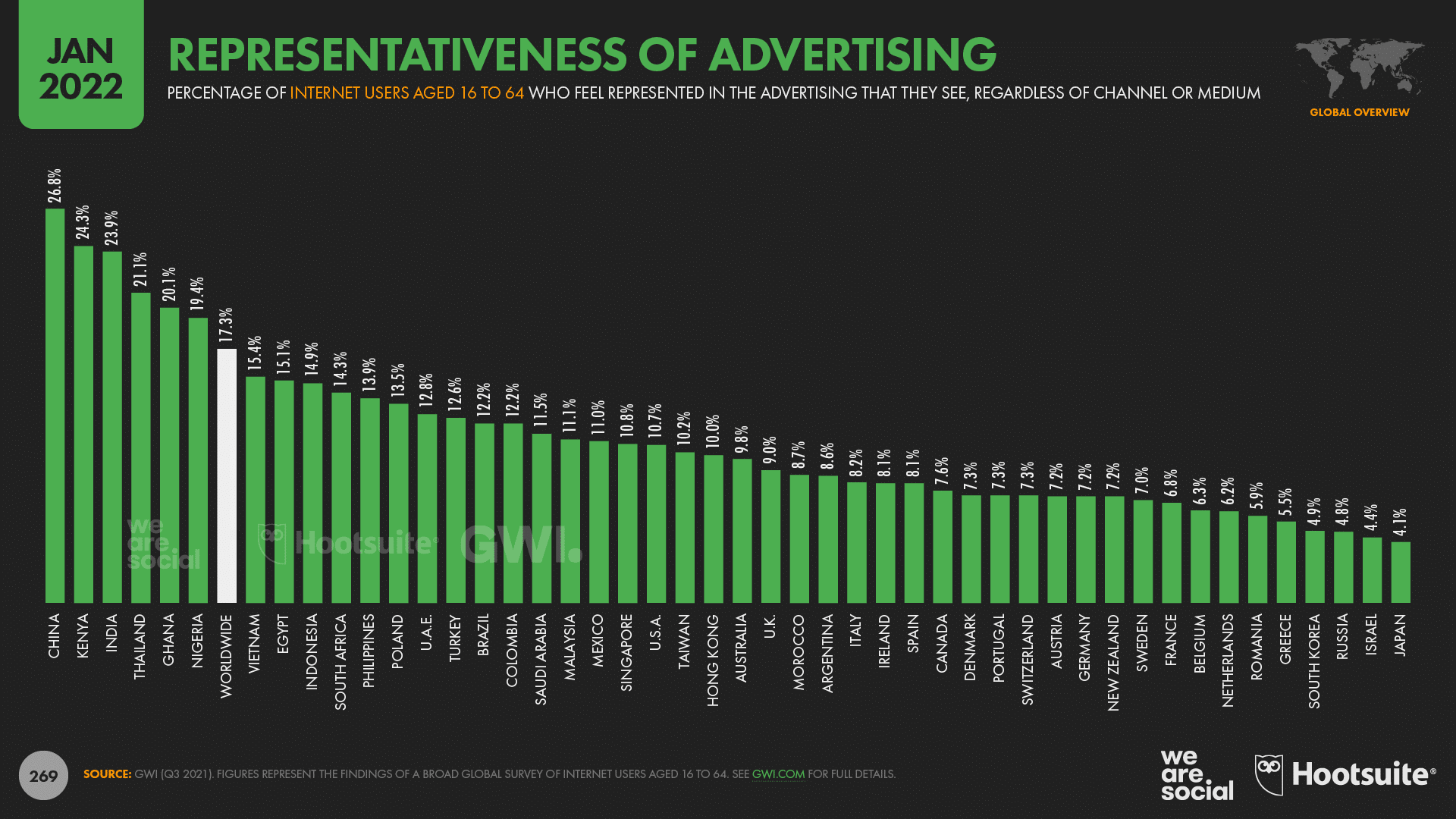

Another alarming finding from this year’s survey is that just one in every six working-age internet users (17.3%) say they feel represented in the ads they encounter, regardless of the advertising media.

At the higher end of the scale, GWI says that individuals in China are the most likely to say they feel represented in advertisements, with slightly more than one-quarter (26.8 percent) responding in the positive.

However, just one in every nine Americans shares this viewpoint, and the proportion decreases to one in every eleven in the United Kingdom.

Despite Japanese firms spending more than USD $47 billion on advertising in 2021, Japan ranks towards the bottom of the rankings, with just one in every 24 respondents claiming they feel represented in the commercials they see.

This low performance, however, may be owing in part to Japan’s high median age.

Indeed, GWI’s data shows that, globally, older individuals are particularly disconnected from advertising, with just one in nine worldwide internet users aged 55 to 64 (10.8 percent) stating they identify themselves in the advertising they see.

However, this is one of the numerous difficulties in comprehending and acting on this data.

Should advertising represent the audience it is aiming at, or should it give a different perspective (for example, a more “aspirational” lifestyle)?

This is one of the most heated marketing problems, and there are no clear answers.

The biggest advise I can provide is to devote time and resources not just in knowing your specific audience’s lives, but also in understanding people’s ambitions, dreams, and concerns.

Traditional research will be a useful tool in this situation, and many of the data partners mentioned in this year’s reports will be able to assist.

Regular social listening, in my opinion, may give some of the most profound insights into what people truly care about.

As you finalize your 2022 plans, set aside some time and money for active study of what matters to your viewers and what “ad representativeness” may look like on their terms.

Ecommerce continues to boom

The advances in ecommerce adoption that we’ve witnessed since the start of the COVID-19 epidemic show no indications of abating, as we projected in our Digital 2021 forecasts, even as mobility limitations come and go.

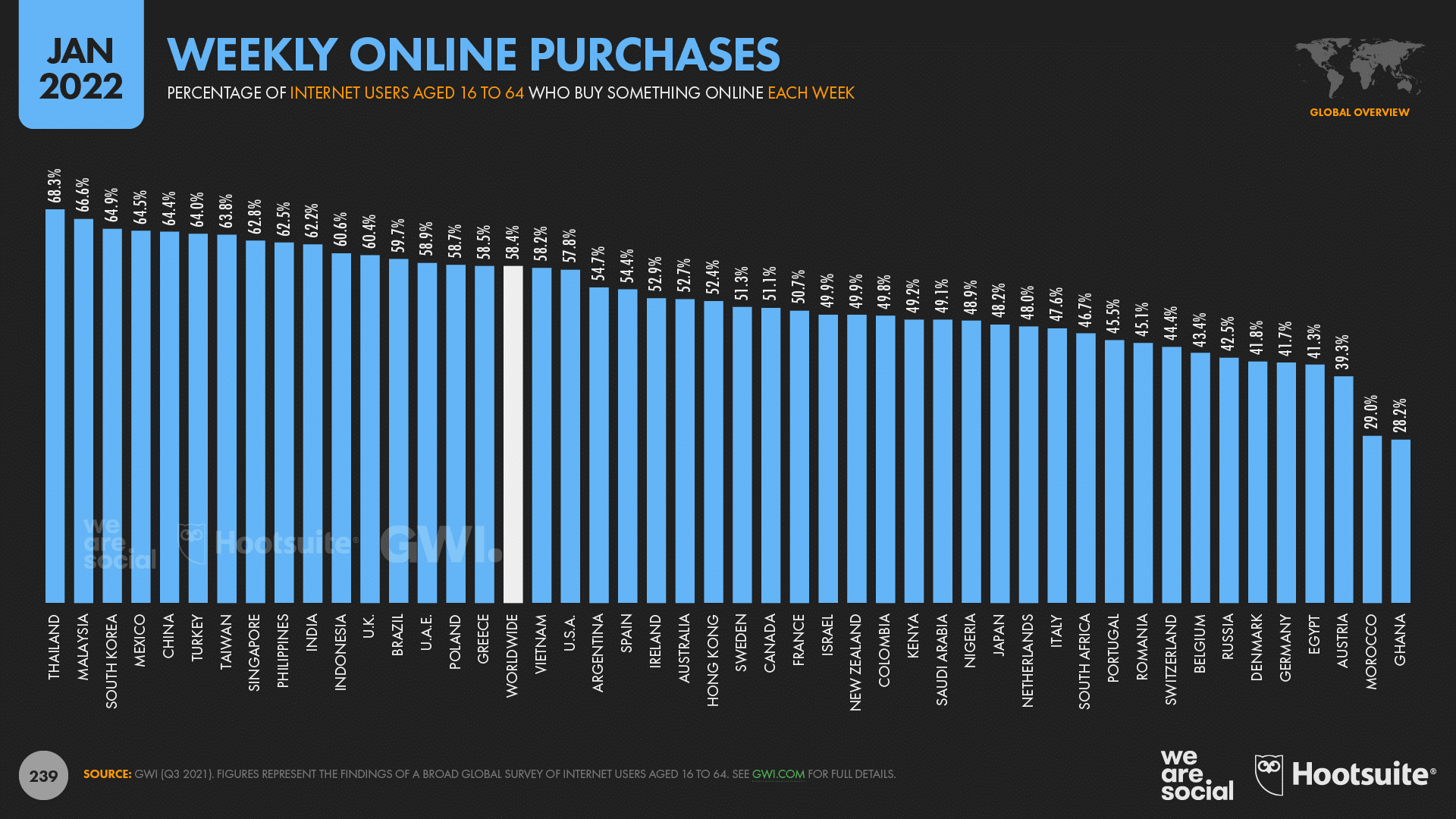

According to GWI data, over six in ten working-age internet users (58.4 percent) already buy something online once a week, with that percentage expected to climb into 2021.

Many of our lockdown-inspired behaviors have also persisted, even when people return to the outside world.

For example, nearly three in ten of us (28.3 percent) now purchase groceries online at least once a week, with the absolute number of online grocery consumers growing by 10% in just the last six months.

Meanwhile, grocery expenditure has increased much faster than user numbers.

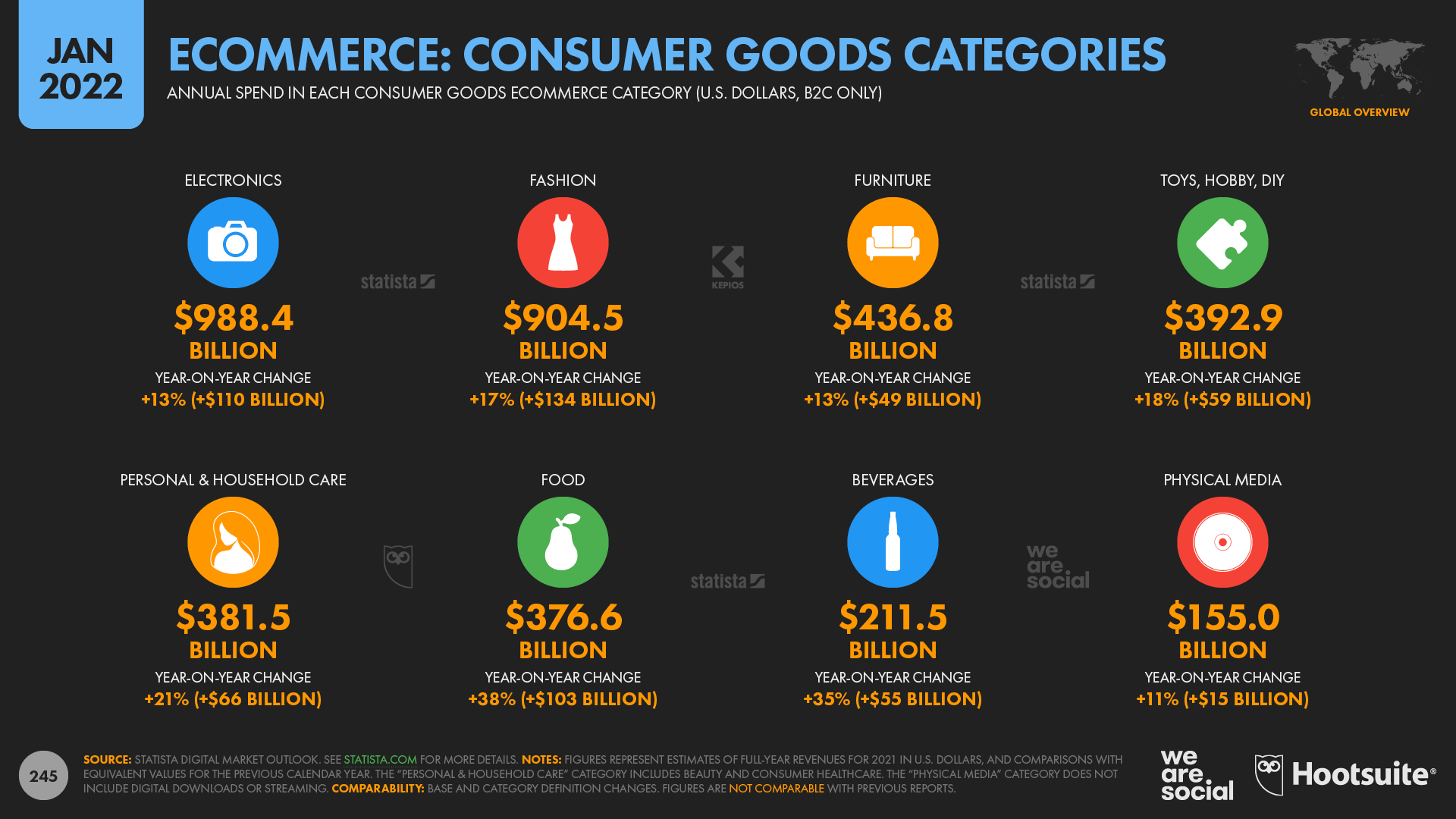

According to Statista’s Digital Market Outlook, online spending in the Food and Beverage categories will increase by more than 35% in 2021, with total yearly sales in these two categories reaching $588 billion.

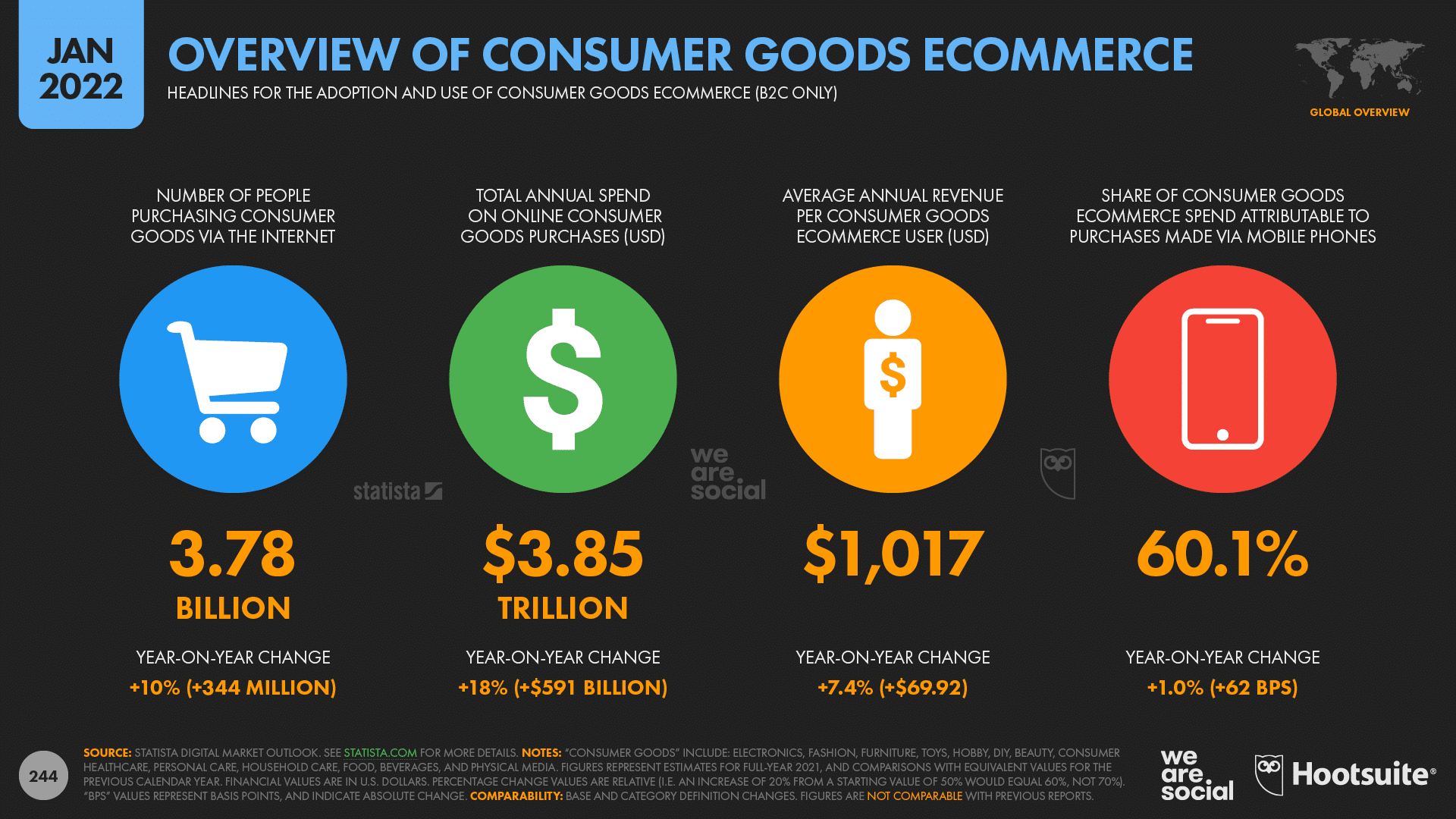

Global revenues related with online sales of “consumer goods”—which include food, apparel, electronics, and other home items—increased by more than half a trillion US dollars (+18 percent) in 2021, totaling USD $3.85 trillion for the year.

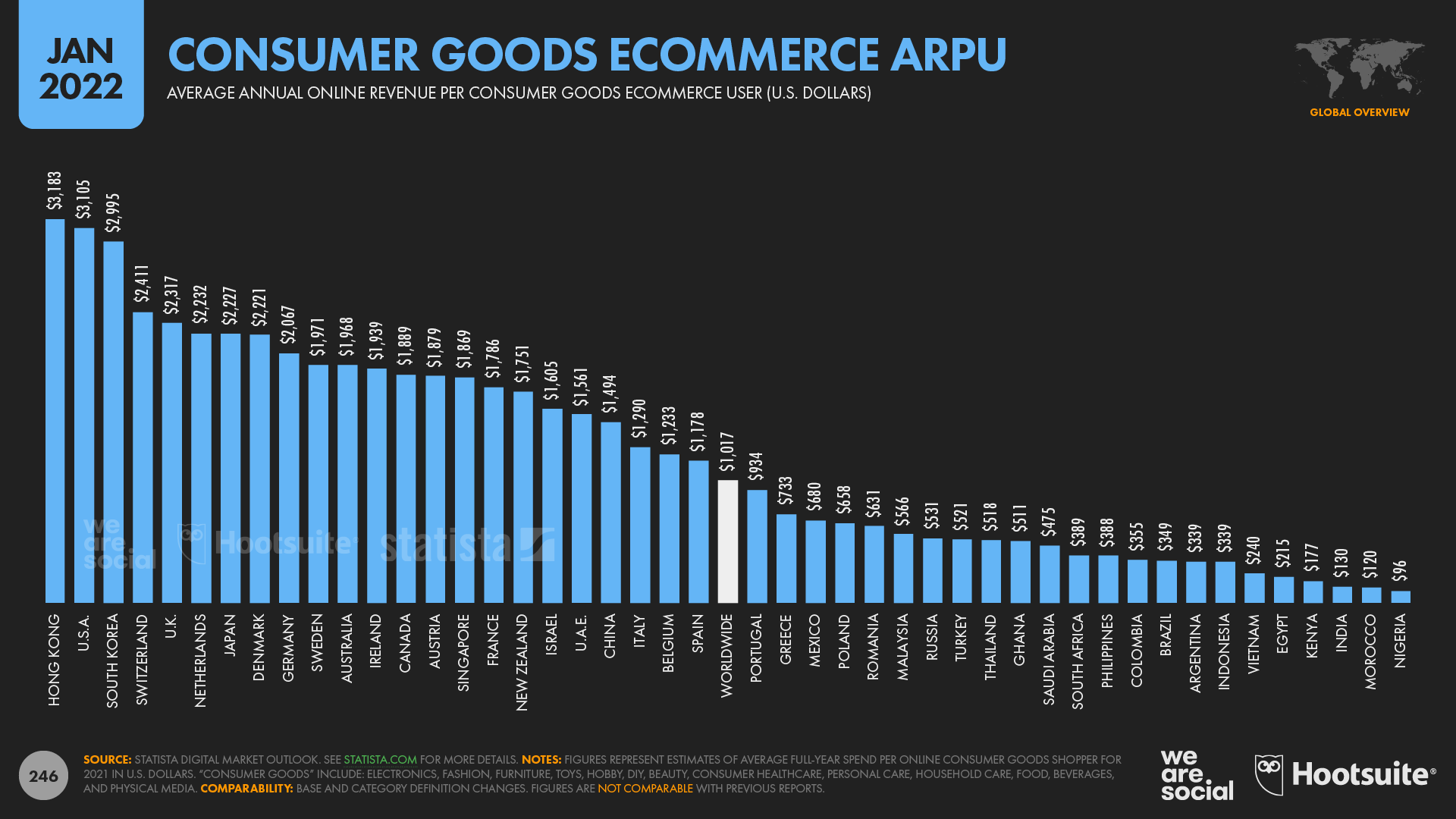

According to Statista, the world’s ecommerce customers currently spend more than USD $1,000 per person, per year on online consumer goods transactions.

However, once again, the tale differs greatly depending on region.

The average revenue per user (ARPU) for online consumer goods purchases in Hong Kong and the United States currently surpasses USD $3,000 per year, but remains below USD $100 in Nigeria.

This year’s report also contains some more encouraging news for travel businesses.

Online travel revenue is still significantly smaller than it was in 2019, but consumer spending has climbed consistently over the last year.

According to Statista’s Mobility Market Outlook, worldwide internet spend on flights will increase by USD $11 billion (+6.8 percent) in 2021, reaching a total of USD $173 billion for the year.

However, the value of internet hotel bookings has risen even faster, with global revenues increasing by 45 percent over the previous year.

In 2021, the globe spent $142 billion on internet hotel bookings, with yearly sales growing by USD $44 billion over the previous year.

However, the most recent data show that ecommerce isn’t simply about buying “the latest and best.”

According to GWI research,’recommerce’ is also becoming more popular, with one in every seven internet users aged 16 to 64 (14.4 percent) purchasing a used or second-hand item online each week.

Social commerce takes off

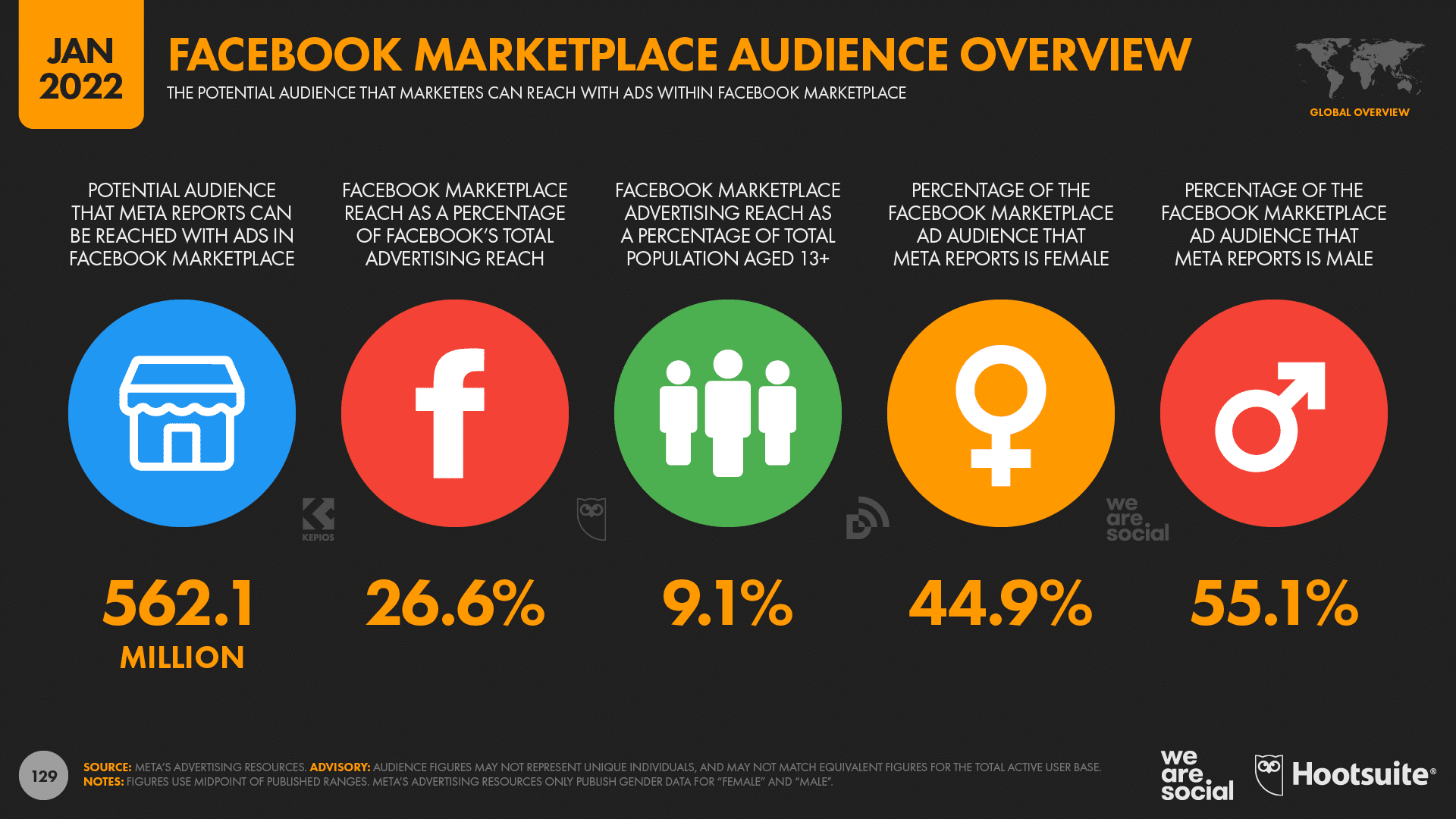

Figures for ad reach on Facebook Marketplace and Instagram Shop are new additions to this year’s statistics.

Various numbers only show the number of consumers that marketers may reach with advertising in these settings, and they may not represent the whole active user base of each environment.

Indeed, Meta says that more than 1 billion Facebook users browse Marketplace each month, implying that there is a significant disparity between total Marketplace users and the proportion of those users that view advertising within Facebook’s commerce environment.

However, this disparity extends across other Meta products as well, and our data indicates that Facebook’s overall ad reach accounts for just roughly 72% of the platform’s entire monthly active user number. [See Data Reportal for several possible reasons.]

Furthermore, the data from Marketplace and Instagram Shop continue to tell a fascinating tale, demonstrating that social commerce has already acquired traction.

Ads on Facebook Marketplace, for example, now reach more than 560 million people each month, accounting for more than a quarter of the platform’s overall ad reach.

In accordance with general platform demographics, Facebook Marketplace attracts a more masculine audience, with males constituting 55% of the Marketplace audience.

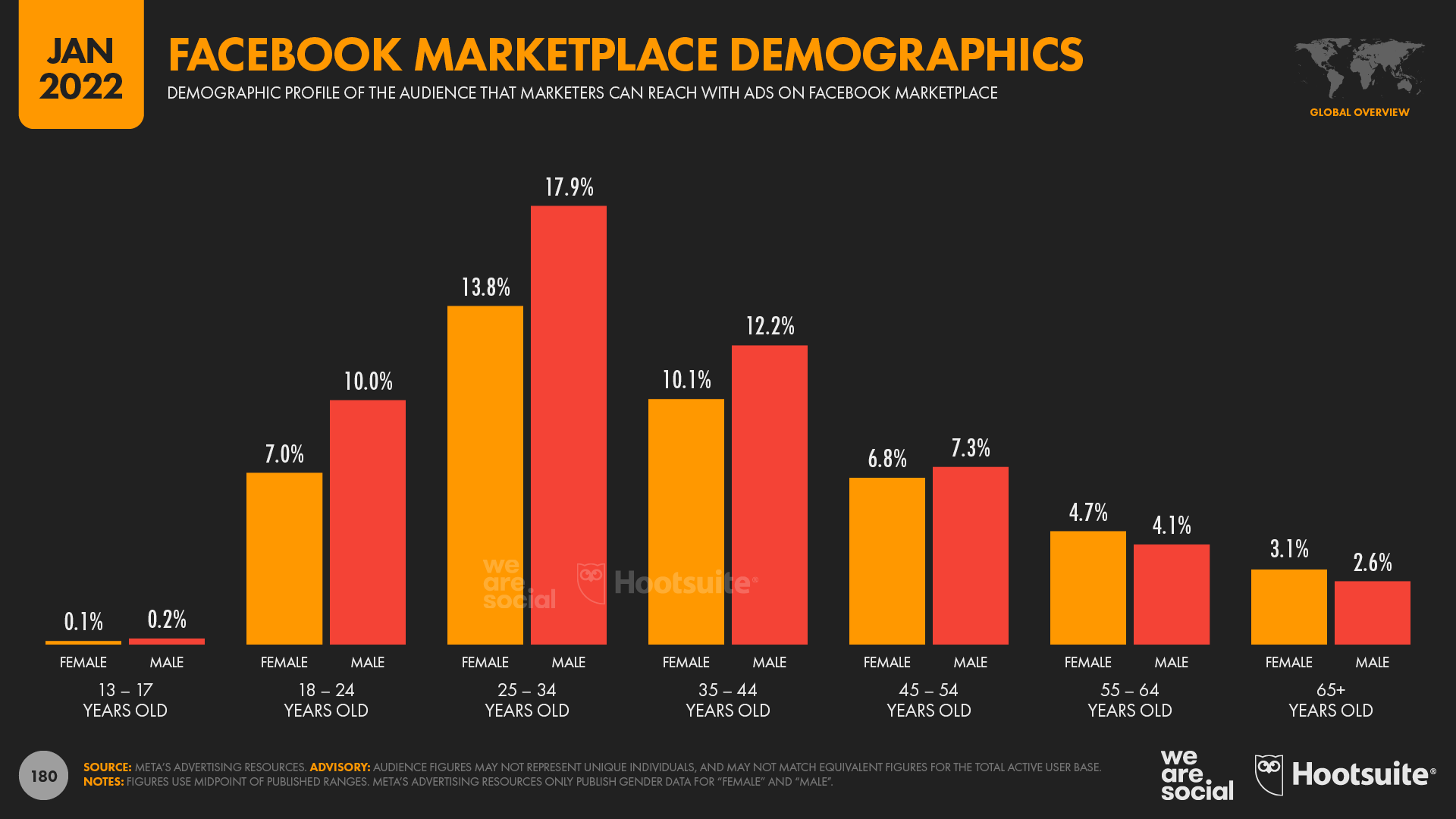

The most intriguing discovery, though, is that the Marketplace audience is significantly older than the Facebook audience as a whole.

Users over the age of 35 make for more than half of Marketplace’s worldwide ad audience (50.9 percent), but just 40.9 percent of Facebook’s total ad audience.

It’s worth noting that Facebook limits Marketplace use to those aged 18 and above, which explains why the statistics in the youngest age range are so low.

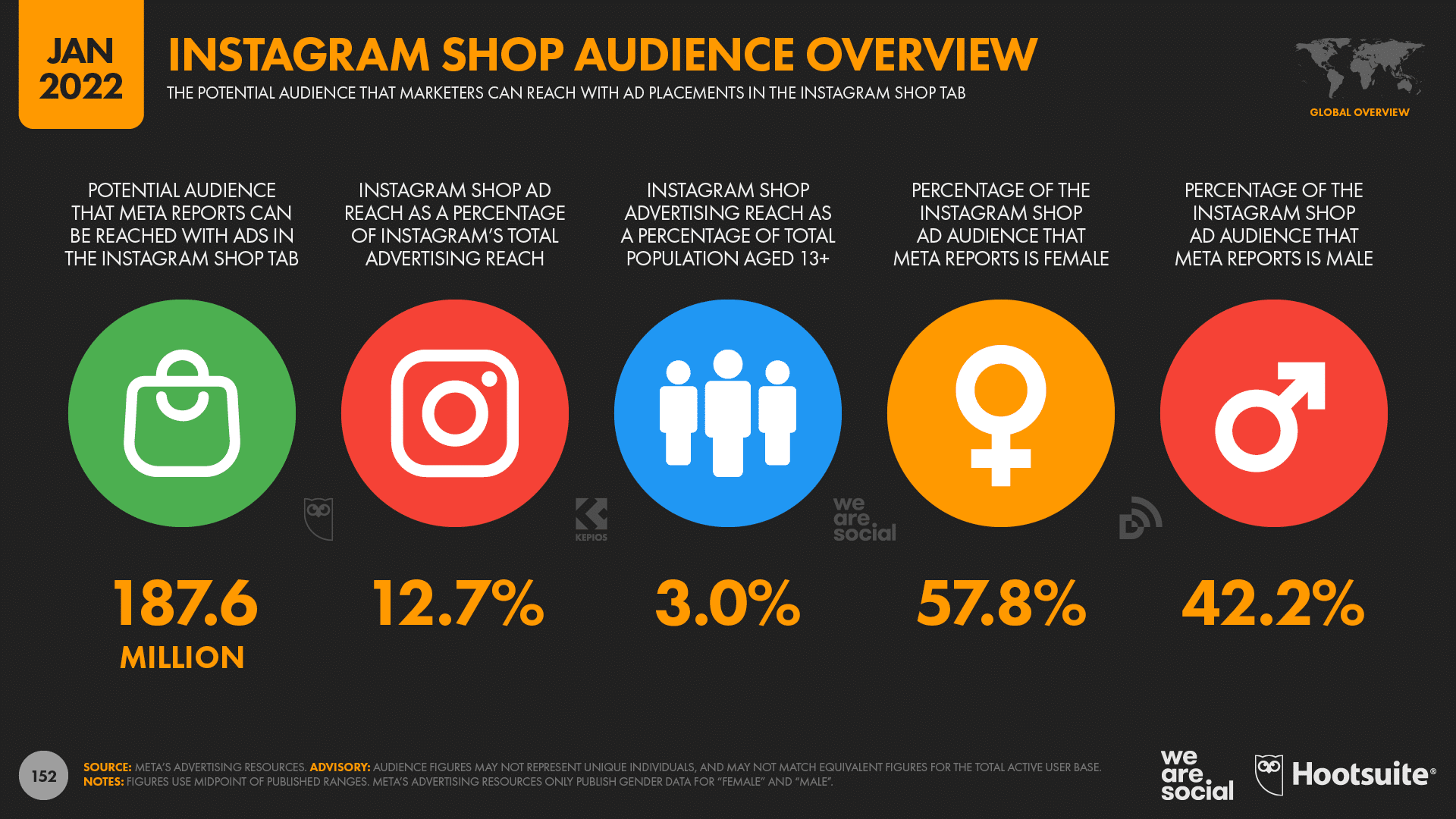

Instagram Shop has also begun to gather traction, with Meta’s tools estimating that marketers can now reach more than 187 million people each month with advertisements under the Shop tab.

In contrast to the findings for Marketplace, the data show that women make up a substantially larger percentage of Instagram Shop’s worldwide ad audience.